FINANCIAL LITERACY

A unique component of the Middle School curriculum is Speyer’s Financial Literacy Program. Students learn all aspects of financial responsibility, from interpreting advertising claims and balancing the bottom line to the importance of creating a budget and how credit scores are used.

The Financial Literacy Program allows students to work in small groups with mentors from PricewaterhouseCoopers LLP throughout the year to discuss financial topics, as well as provides opportunities for certain grades to visit a trading floor and present what they have learned to professionals at a major investment bank.

Each grade explores specific financial themes, dissecting them into smaller topics. In the fifth grade, students learn how to evaluate financial information to make solid decisions, with lessons on advertising, saving and investing, and consumer fraud. Sixth graders delve into sustainability and conservation, covering topics such as the impact of purchase choices and the financial and environmental implications of energy efficiency and recycling, as well as the importance of saving and spending. Seventh graders study about credit and debt, but primarily spend the year managing Speyer’s Financial Literacy Fund Portfolio (see more on that below), which gives them hands-on experience with all aspects of stocks, bonds, trades, and incorporating social justice while investing. In their final year, eighth graders learn about essential financial skills such as financial planning, budgeting, and charitable giving. They also explore of various career paths and skill sets needed for success in the modern workplace.

Though practical in essence, Speyer’s Financial Literacy Program is, at its core, about building the character of our students, empowering them with tools that nurture their inner foundation of integrity and ethics, tools to use after they leave Speyer and become citizens and leaders of the world.

SPEYER’S FINANCIAL LITERACY FUND PORTFOLIO

Financial Literacy Fund Portfolio is a centerpiece of the seventh-grade financial literacy curriculum, where the students manage a real portfolio, which was a gift from a Speyer family.

Each incoming grade has a gift of $20,000 and over their nine years at Speyer, this portion will grow with investment returns. At the time of their eighth-grade graduation, the original $20,000 rolls forward to the incoming Kindergarten class, and the increase in total value from inception is quantified.

This value is then split into two: first half is allocated by the eighth graders as a graduation gift back to Speyer, and the second half is gifted pro rata to the students themselves to further their education.

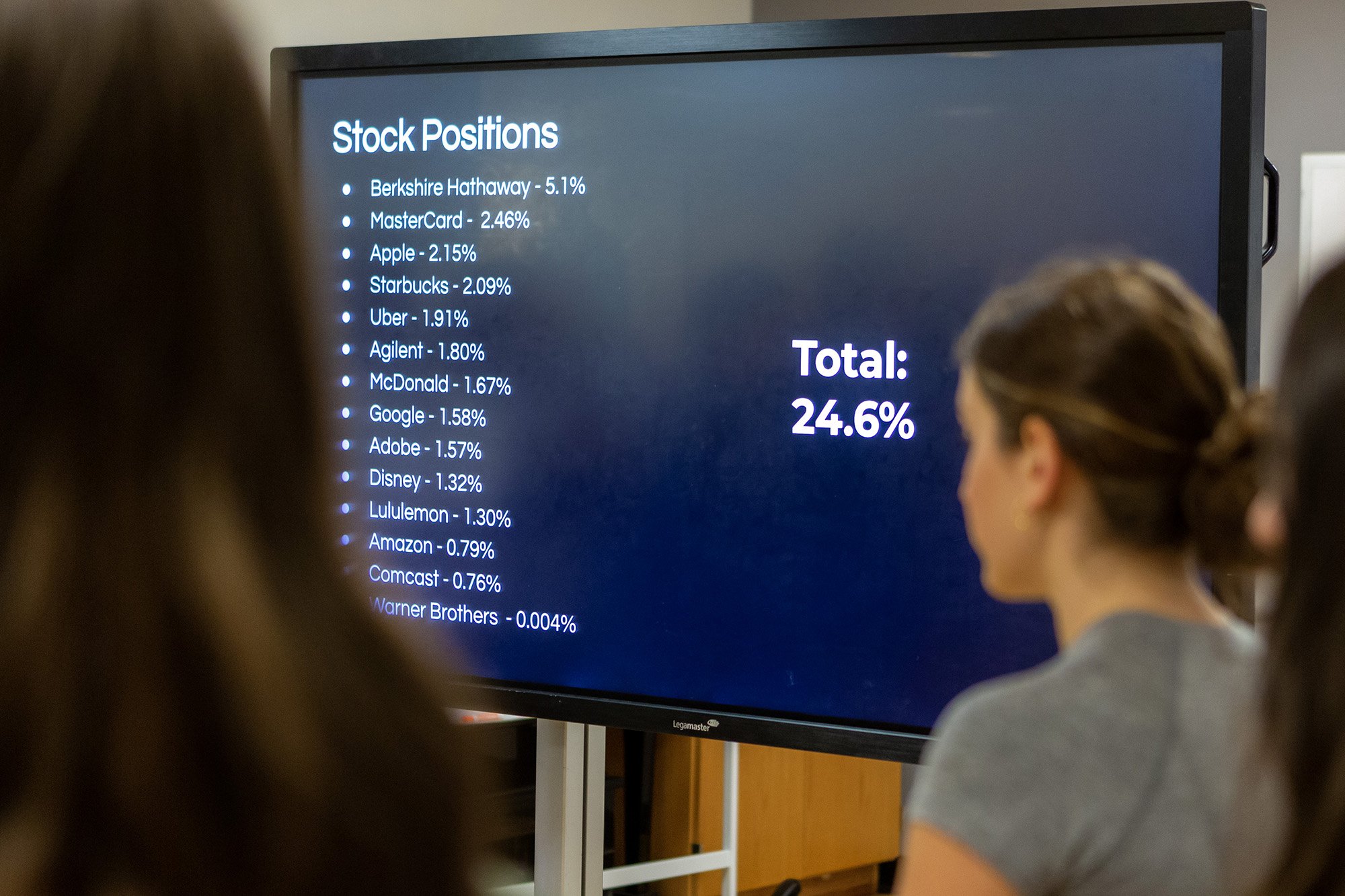

At the start of the school year, students in the seventh graders take responsibility to review and rebalance the portfolio (with advice and oversight from independent investment analysts at a major bank and Speyer faculty and administration). The students learn about stocks, bonds, mutual funds, exchange traded funds, diversification, trading costs, and social investing strategy.

Currently, the portfolio is approximately $258,000. As far as we know, no other seventh graders in the country manage an investment portfolio of this magnitude. This is unprecedented, and yet another example of what makes Speyer's curriculum so rich and relevant.